Though no indicator is perfect, having a solid grasp of using the Awesome Oscillator can be an incredible advantage against a market that isn’t always sure where it’s headed. The Awesome Oscillator is a great momentum indicator, being easy to use for newer traders while offering a deeper complexity for more experienced traders to dive into. When the price is higher than before, the histogram produces a green bar, and if the price is lower, the histogram creates a red one. Created by the famous technical analyst and American trader Bill Williams, the Awesome Oscillator is plotted as a histogram, primarily using red and green to signify price difference since the previous period. One of the most reputed and widely-used indicators for tracking market momentum is the Awesome Oscillator. While it cannot protect investors against external market events, it’s always important to know when a momentum indicator signals a fundamental shift in sentiment over a temporary price movement. Put plainly, momentum cannot predict price movement but instead reflects the overall market’s sentiment. Traditional markets usually experience corrections soon after a positive momentum movement, as the markets adjust their expectations, causing the price to retrace lower.Ĭryptocurrencies usually experience something similar, but since liquidity in these markets is much lower, many corrective moves correlate to early investors and whales selling off to reel in profits. However, with analysts and day traders constantly tracking the market’s movements, once the fundamentals of a strong momentum are locked in, the price can shoot up rapidly, especially in markets as volatile as cryptocurrencies.įor momentum investors, the ride up is the most profitable part of the movement, with prices moving at high velocity and trade volumes soaring through the roof. Just like when a train accelerates from standstill to its top speed, the train will continue to move even after it stops accelerating before decelerating back to a halt. This is because markets tend to rise more often than they fall, meaning bull markets can last longer than bear markets, giving growing markets more time to build momentum. The market’s momentum reflects the velocity of price changes, but history has shown that momentum is a much more reliable indicator in rising markets than falling ones.

HISTOGRAM MAKER MIDPOINTS UPGRADE

In cryptocurrency markets, events like a successful protocol upgrade or governance voting systems’ results can positively or negatively affect momentum. A company can also induce positive momentum by announcing its debt obligations or an increased projected cash flow. In traditional markets, new of growth in corporate profits could increase equities momentum, while a rise in interest rates can catalyze negative price momentum.

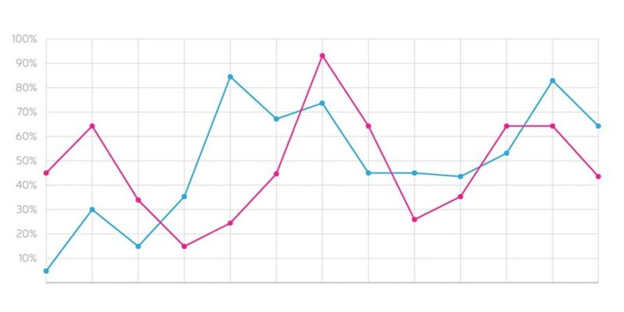

The positive or negative difference is then plotted over a zero line, but there are numerous factors beyond just price that can affect market momentum.

Market momentum is broadly calculated using the difference in the latest price of an asset and its cost a specific number of days prior and is measured by regularly taking price differences over fixed time intervals. Positive momentum indicates the potential for a bullish trend, while negative momentum indicates the opposite. Momentum indicators give analysts a better idea of a trend’s strength, which can be a great indicator of future price movements. Using technical indicators, investors can use them to predict price movement, at least to some degree of success. Technical analysis helps traders forecast the probability of the price moving in a particular direction. However, market momentum is also a measure of the market’s sentiment towards certain events, and it’s only through understanding the market that traders can think ahead of it. The term is used to define a function of change in price over a specified period against trade volume, meaning higher volumes have more impact on the momentum of price actions. Markets are constantly moving, and its ability to sustain price movement in one direction is called market momentum.

0 kommentar(er)

0 kommentar(er)